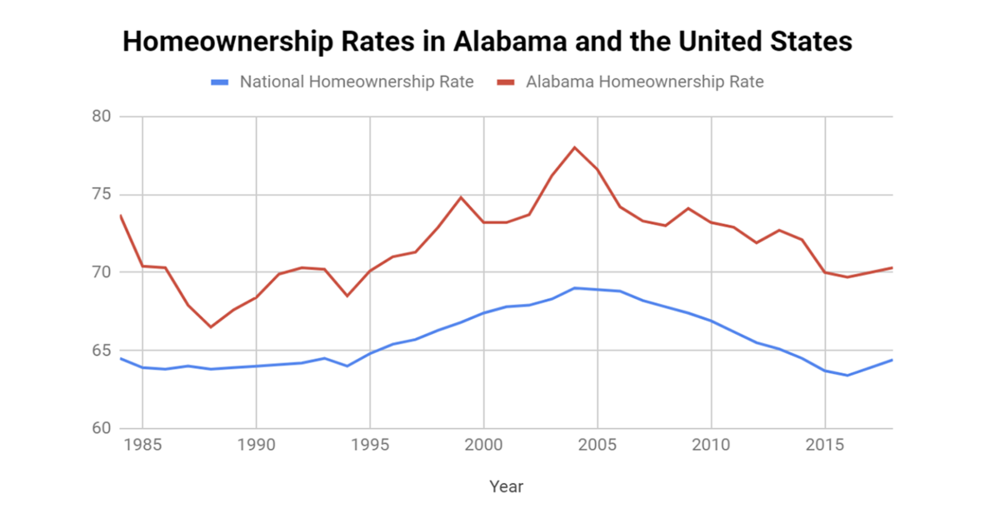

While homeownership rates nationwide were on the rise during the third quarter of 2019, they decreased slightly in Alabama during the same period. However, Alabama continues to have higher rates of homeownership than the national average (69.1% vs. 64.8% during Q3 2019).

Alabama’s homeownership rate declined 2 percentage points quarter-over-quarter from 71.1% in the second quarter of 2019 to the current rate of 69.1%. The year-over-year decline was significantly less as homeownership rates fell 0.4 percentage points from 69.5% in the third quarter of 2018. It was surprising to see Alabama’s rate decline during a time when mortgage rates are also falling, but residential markets in the state continue to be impacted by a relatively small amount of properties listed to sell. The total number of homes on the market dropped 9.7% year-over-year in September, and has contributed to rising home prices in recent years. Additionally, residential listings are especially tight at the entry-level price point, which can potentially price many would-be homeowners out of the market.

The nationwide homeownership rate increased 0.7 percentage points quarter-over-quarter from 64.1% in the second quarter to 64.8% in the third quarter. The rate also increased year-over-year, up 0.4 percentage points from 64.4% in the third quarter of 2018. While falling interest rates did not coincide with growing homeownership in Alabama, they were a significant factor in the growth of homeownership at the national level. The third quarter boost also places the U.S. homeownership rate very close to its long-term average of 65.2%. If current trends continue, this benchmark could be reached by 2021.

Mirroring national trends, Alabama’s homeownership rate peaked in the first quarter of 2005 at 77.1%. The Great Recession played a significant role in dragging homeownership rates downward from 2007 to 2009. But, surprisingly, rates were lower in the aftermath of the Great Recession than they were during it. Alabama’s homeownership rate bottomed out at 67.2% during the fourth quarter of 2014 but has steadily recovered since that time.

Alabama’s homeownership rate is consistently above the national average for several reasons. Alabama’s county and local governments incentivize homeownership by having some of the lowest effective property tax rates in the nation. And real estate in Alabama, generally speaking, is more affordable than the nation as a whole. A recent analysis by the Alabama Center for Real Estate found that a family earning the statewide median family income of $63,500 had approximately 1.99 times the income necessary to qualify for a loan (80% LTV) to purchase the statewide median priced home ($180,868). Nationwide, families earning the national median family income of $75,500 have approximately 1.55 times the income necessary to qualify for a loan to purchase the nationwide median price home ($277,133).

So how does homeownership in Alabama compare to other states? Let’s begin by comparing Alabama to neighboring states: Alabama (69.1%) is lower than Mississippi (73.7%) and Tennessee (69.3 percent), but higher than Florida (65.5 percent) and Georgia (65.4 percent).

Here are the highest homeownership rates in the United States during Q3 2019:

(Note: Alabama ranked 23rd)

- 1. West Virginia: 78.1 percent

- 2. New Hampshire: 75.4 percent

- 3. Maine: 74.4 percent

- 4. Mississippi: 73.7 percent

- 5. Minnesota: 73.4 percent

- 6. Michigan: 73.3 percent

- 7. Idaho: 73.1 percent

- 8. (Tie) South Carolina and Wyoming: 72.1 percent

- 9. Delaware: 71.9 percent

- 10. Indiana: 71.5 percent

—

ACRE Research Intern Brian Garutto contributed to this article.