When analyzing the profitability of a market we can look at infrastructure, location, return on investment; all of these factors are vital to determining investment strategies. But one crucial metric can be used as a tell-all on whether or not the market is strong for income producing residential properties – Price-to-Rent ratio.

What is Price-to-Rent Ratio and what is it telling us about the market?

Price-to-Rent ratio is pretty straight to the point; a deterministic factor of whether or not consumers in an area should favor to buy or to rent a property and exactly how much cheaper it is to rent. This can be very important information for potential investors on whether or not they should flip their property or lease it to potential tenants. As we can see below, high dollar markets such as New York City, Seattle or San Francisco have very high price to rent ratios, these are markets that have extremely high home values with relatively low monthly rents.

Although these are good indicators against the rest of our data, it is crucial to point out that these numbers are a tad lower than market norms due to the source of data, which provides rent and price of similar homes rather than averages.

A price-to-rent that exemplifies a market that is better to buy than rent would be somewhere in between 0 and 7, a riskier market would be around the 8-12 range, while 13 and up is a market where renting is much preferred over buying.

What is the trend for the rental market in Alabama and where are we headed?

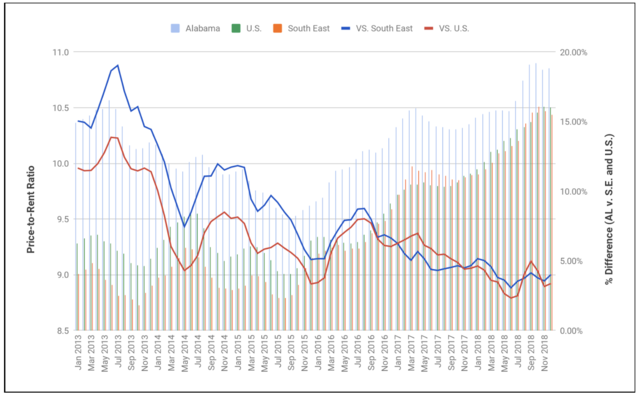

Like any market trend, Alabama is following the rest of the U.S. and South rather closely. Alabama is an average of 8.4 percent higher than the rest of the South and 6.6 percent higher than the U.S. in price-to-rent ratio in the past 5 years. This means that it is cheaper, on average, to rent a house or apartment in the state of Alabama than the rest of the country. This could be due to anything from the state’s recent sprawl to high-end multi-family complexes in urban areas to the fact that Alabama has a relatively high median age. Regardless of its origins, this could mean a number of things for investors; as buyers become economically aware they will prefer to rent instead of buy, apartment housing is growing in demand, buyers are ready for development or at the moment buyers prefer to stay in homes. While price-to-rent ratios are rising nationwide and Alabama’s statewide ratios are increasing, we can detect that Alabama is closing in on the national average. Observe the graphic below, we can see that on the left axis, nationwide, southeastern and statewide ratios are growing, while on the right axis, Alabama’s percent difference in ratio is shrinking.

This means that Alabama can expect to catch up with large southern metros like Nashville, Atlanta, Charlotte, that have seen booms in multifamily housing in recent years.

What does this mean for multi-family growth in the state?

According to Cushman & Wakefield’s 2017 Q2 market analysis on areas such as Birmingham, Huntsville, Mobile and Montgomery, there has been a steady growth in multifamily housing in recent years (On average, a 5-YoY growth of 1.4 percent). It is to be believed that these growth numbers are directly affecting the rise and market equilibrium of the price-to-rent ratios observed above. Another indicator we can look at in regards to multifamily development is the crane index in Alabama’s major metros. According to Business Journal’s Birmingham Crane watch, 10 Birmingham cranes are currently up working on multi-family projects as opposed to 2017 where there were only four cranes working on multi-family projects. This goes to show that the more our market percent differences begin to even out with the rest of the country all while price to rent ratios rise and or stay at a steady 15-20 percent, we can expect multi-family housing to be in demand and to be thriving in the state of Alabama.

Where to buy or rent in the state of Alabama

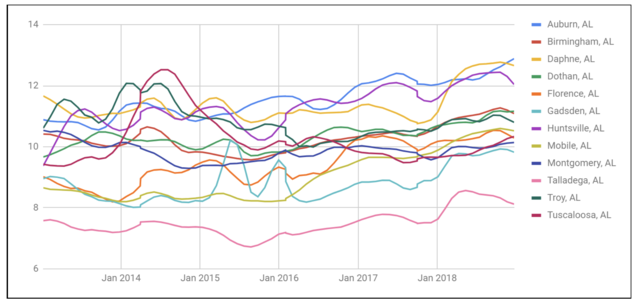

Right now, the state is a bit of a mixed bag, though for the most part, ratios have slightly increased over the past 5 years. For large metro areas (think Birmingham, Mobile, Huntsville), we have seen that housing prices in the state are realizing growth at a faster rate than that of rent rates.

Above, we can observe average price over the past five years as compared to average monthly rents, this should give us a pretty good idea on which markets are hot for rental properties. Also observed below is at which these rates have grown over these past five years. Certain markets, especially Huntsville, Auburn, Dothan and Mobile are seeing affordable rents over home values, this is something to consider for investors as these cities see new jobs and economic growth. Similarly, college towns in the state such as Tuscaloosa, Auburn, Troy to mention a few, are seeing booms in student housing and increased enrollment (average 4 percent growth at Auburn and 2 percent at UA over the last five years).